Weekly Market Performance — September 20, 2024

- J. J. Wenrich CFP®

- Sep 19, 2024

- 9 min read

Markets Blog

David Matzko, LPL Research

Weekly Market Performance for the week of September 16, 2024. Central banks took center stage across global markets this week, with a historic rate cut from the Federal Reserve (Fed) on Wednesday, and monetary policy and rate decisions in England, Japan, and China. U.S. stocks extended last week’s advance largely on the back of a post-cut rally as investor confidence in the economy powered major indexes higher. Despite Wednesday’s rate cut, Treasury yields rose as the bond market continues to digest the updated Fed dot plot. The dollar steadied after mid-week swings, and gold reached new all-time highs.

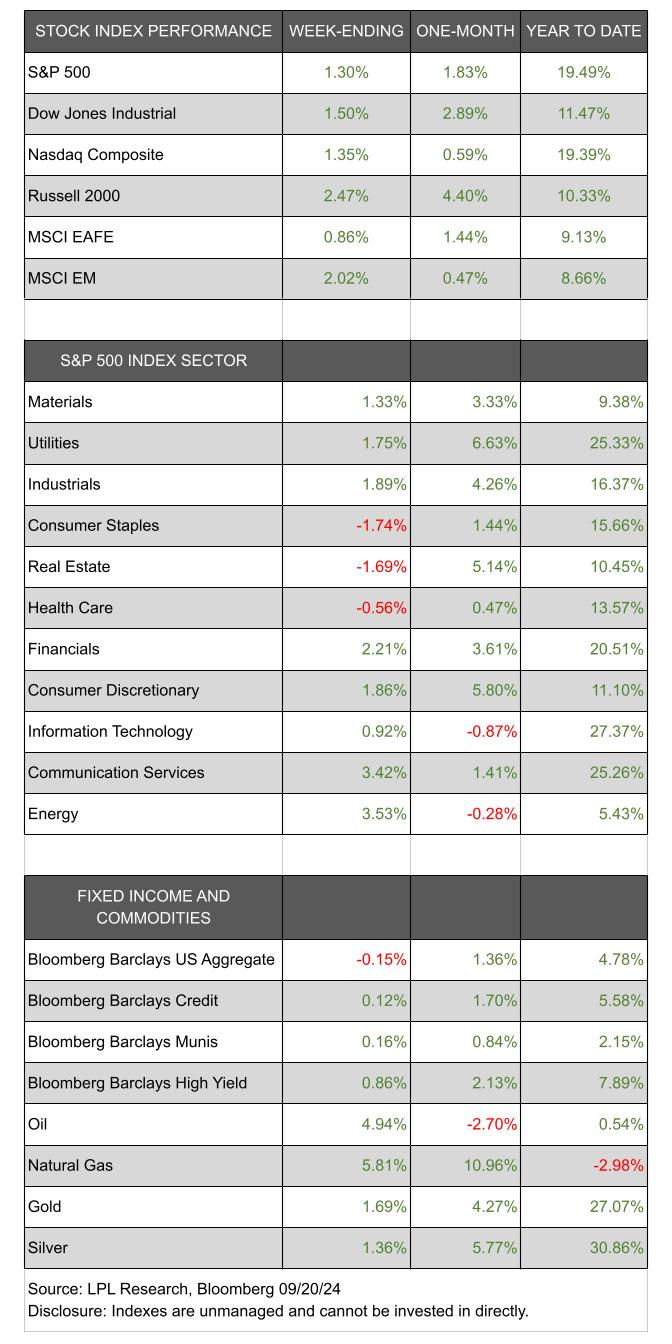

Index Performance

U.S. and International Equities

U.S. Equities: Despite the overhang of September’s poor reputation for stock performance, markets extended last week’s rally with another solid weekly gain. Driven largely by a post-rate cut surge, the Nasdaq and S&P 500 advanced 1.3%, and the Dow added 1.5% over the last five sessions. The S&P 500 logged more all-time highs, sending the total number of records for 2024 towards 40, while the Nasdaq approached record-high territory. Small caps also traded higher on the week, as the Russell 2000 added 2.5%, outperforming their large cap peers.

There’s no question that the biggest news this week was the long-anticipated September meeting of the Federal Open Market Committee (FOMC) and their monetary policy decision, which was expected to be the first rate cut in four years to start the monetary easing cycle. Stocks treaded water while in waiting mode early in the week, with chatter around Wall Street not centered around if the Fed would cut rates, but by how much. Stocks jumped immediately following the Fed’s announcement of a bold, half-percent (0.5%) rate cut on Wednesday afternoon; however, the initial bounce faded as Jerome Powell signaled that large cuts are not expected to become the norm. Nonetheless, stocks surged on Thursday in a somewhat delayed rate cut rally, as soft-landing optimism and dampened recession fears powered a rotation back into big tech.

Friday closed the week on a softer note, as stocks weakened following disappointing second quarter results and a tepid outlook from delivery and freight giant FedEx (FDX), and amid rising geopolitical tensions after an Israeli strike in Beirut. Also among corporate headlines, Intel Corp. (INTC) announced an alliance and chip production deal with Amazon Web Services, sending the stock to a weekly gain, and Microsoft (MSFT) raised its dividend and announced a new $60 billion dollar share buyback.

International Equities: International markets kept the Fed policy decision in focus throughout the week, however, central bank decisions outside of the U.S. drew investor attention as well. European stocks ended slightly lower on the week after rallying intra-week with U.S. markets, as the Bank of England (BoE) held rates steady in a nearly unanimous decision. The central bank also cautioned that future easing will be gradual as the BoE is not in a rush to ease policy.

Economic data also made headlines, highlighted by the August Consumer Price Index (CPI) for the European Union (EU), which placed downward pressure on stocks after coming in weaker than preliminary monthly readings, but in-line with annual numbers. And on the corporate front, shares of Mercedes-Benz Group fell, weighing on the broader market, after unexpectedly slashing financial forecasts and profit expectations.

Trading volume was relatively thin in Asia for the week, with Japan, South Korea, greater China, and Taiwan all shuttering exchanges at least one day for holidays. The region recorded a weekly gain, led by Hong Kong and the tech-leaning market of South Korea. Following the Fed decision on Wednesday, and the BoE decision on Thursday, the Bank of Japan (BOJ) delivered its decision to leave rates unchanged on Friday. Japanese stocks advanced in response, and rose sharply on the week, as BOJ Governor Ueda’s comments were perceived as firmly dovish. China also gained ground on the week, overcoming weak economic data over the weekend and the People’s Bank of China (PBOC) not adjusting benchmark lending rates, which left investors discussing when the central bank will respond to a weakening economy. Taiwan and Australia ended higher, while India logged new record highs.

Markets

Fixed Income: The Bloomberg Aggregate Bond Index traded lower on the week, as yields put together an advance across the curve despite the Fed’s first rate cut since 2020. The 10-year yield ended near 3.72%, while the monetary policy-sensitive 2-year yield traded near 3.57% Friday afternoon. The yield curve steepened and continued to further move towards un-inverted, or “normal”, levels, with the 2-year and 10-year yield spread also continuing to widen.

While the Fed slightly surprised markets by cutting rates by 0.50% (they were going to surprise markets either way given the uncertainty in fed funds futures pricing), yields actually ended up higher on the week. Of note for fixed income markets though, aside from the 0.50% cut, was that the long-run neutral rate edged higher again after the September meeting. The so-called neutral rate is the interest rate that is neither restrictive nor supportive, and the rate that the Fed will try to take the funds rate to during this rate-cutting cycle (absent a recession or need to stimulate the economy). After hovering around 2.5% for years, Fed officials are suggesting the neutral rate is now closer to 3% and could move higher still. The neutral rate limits the ability for Treasury yields, broadly, to fall much further from current levels. Additionally, the updated Fed dot plot, which shows what the committee thinks the Fed funds rate should be over time, revealed a dovish tone with 1.00% of easing currently expected for this year (which includes the 0.50% cut this week), and another 1.00% in 2025.

With the economy slowing, but not expected to contract, Treasury yields could consolidate around current levels and perhaps move higher if economic data surprises to the upside. While yields didn’t fall after the rate cut Wednesday, given what was already priced in, the expectation of future cuts could push shorter-maturity Treasury yields lower, so by extending the maturity of holdings, investors can still take advantage of elevated yields before they’re gone.

Commodities and Currencies: The Bloomberg Commodities Index traded over 2% higher in a busy week for the commodities and currency markets. The U.S. dollar index ended the week slightly lower and near recent lows after wild swings on Wednesday following the Fed rate cut. The Japanese yen weakened compared to the U.S. dollar after the BOJ kept interest rates on hold and BOJ Governor Ueda did not provide any indication on when the central bank could decide on another hike. Gold traded at new highs after finding support from lower U.S. rates, which reduces carrying costs of owning the metal, and rising geopolitical tensions following the Israeli attack in Lebanon. Silver edged higher, and despite Chinese economic concerns, copper climbed to its highest levels since July amid the risk-on tone in the latter half of the week on an energy shortage in one of the world’s main copper ore suppliers, Zambia. West Texas Intermediate (WTI) crude ended higher on the week, despite facing an array of pressure over the last five days. Crude prices dropped steeply on Tuesday, however a rate cut rally overnight on Wednesday boosted oil prices back into positive territory. Headwinds in the form of post-rally profit-taking, China concerns after the central bank for the world’s largest oil importer has yet to act despite a sluggish economy, and as Middle East tensions ramped up, causing the commodity to struggle on Thursday and Friday.

Economic Weekly Roundup

Fed Goes Bold. The Fed delivered a 50 basis point rate cut with a clear message they are committed to full employment. Not surprising, the decision to cut rates was not unanimous; however, Chairman Powell mustered some consensus among the hawks and doves on the Committee. The risks to achieving its dual mandate are roughly in balance, minimizing any murmurings that investors think the Fed knows something they don’t about underlying risks to the outlook. Markets responded favorably to the decision as the Fed cut aggressively. This sets the stage for a risk-on response. Growth projections were unchanged, but members of the Federal Open Market Committee (FOMC) now expect unemployment rates to rise higher and faster than they did in their previous projections.

We learned from Wednesday’s Summary of Economic Projections (SEP) that the Fed is interested in getting to a neutral fed funds rate as quickly as possible. Given structural shifts in the global economy, the Fed is willing for the longer-run fed funds rate to approach 2.9%. Looking ahead, the Fed has plenty of room to further normalize rates as inflation decelerates.

Q3 Growth Looking Good. August retail sales were bolstered by online purchases, revealing a more cost-conscious consumer avoiding traditional department stores. Estimates for July sales were revised up as Q3 started stronger than originally reported. Only five out of 13 categories rose in August as sales were mixed across sectors. Last month, 10 categories gained sales. Restaurant spending was unchanged in August as consumers started to pull back on discretionary spending. Department store sales fell for the second consecutive month, putting pressure on retailers to attract customers.

The Fed is dealing with mixed signals as they debate how much to cut rates. Consumer spending is growing despite early signs of labor market weakness, so the Fed may end up falling behind the curve again if they rely too much on stale data and not enough on the forward-looking outlook.

The Week Ahead

The following economic data is slated for the week ahead:

Monday: Chicago Fed National Activity Index (August), S&P Global U.S. Manufacturing PMI (Sept preliminary), S&P Global U.S. Services PMI (Sept preliminary), S&P Global U.S. Composite PMI (Sept preliminary)

Tuesday: Philadelphia Fed Non-manufacturing Activity (September), FHFA House Price Index (July), S&P Case-Shiller 20-City House Price Index (July), S&P Case-Shiller U.S. House Price Index (July), Conference Board Consumer Confidence, Present Situation, and Expectations (September), Richmond Fed Manufacturing Index (September), Richmond Fed Business Conditions (September)

Wednesday: BEA annual revisions to GDP/National Economic Accounts, GDP Annualized QoQ (Q2 third reading), Personal Consumption (Q2 third reading), GDP Price Index (Q2 third reading), Core PCE Price Index (Q2 third reading), Durable Goods Orders (August preliminary), Durable Goods ex Transportation (August preliminary), Capital Goods Orders Nondefense ex Aircraft (August preliminary), Capital Goods Shipments Nondefense ex Aircraft (August preliminary), Initial Jobless Claims (September 21), Continuing Claims (September 14), Pending Home Sales (August), Kansas City Fed Manufacturing Activity (September)

Friday: Personal Income (August), Wholesale Inventories (August preliminary), Personal Spending (August), Real Personal Spending (August), PCE Price Index (August), Advance Goods Trade Balance (August), Core PCE Price Index (August), Retail Inventories (August), Bloomberg September U.S. Economic Survey, University of Michigan Sentiment Report (September final)

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial, LLC. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures –

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax.

Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rate and credit risk. They may be subject to a call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities, and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor's holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

For Public Use – Tracking: 633390

Comments